Don't Have a Budget? QuickBooks Online Can Help

The hardest part of creating a budget is getting started. QuickBooks Online provides tools that can jump-start the process.

You know you should have a budget. You’re aware that it can help you stay on track with your company’s income and expenses throughout the year. Maybe you’ve even tried to make one before, but you got discouraged by the mechanics or by the difficulty of estimating money in and out for the next 12 months.

June may not be the beginning of your fiscal year, but that doesn’t mean you can’t make a serious effort to start building a budget that can help you rein in expenses and set revenue goals.

Here’s a look at QuickBooks Online’s budgeting features.

Creating the Framework

Before you begin, you’ll want to make sure that your fiscal year is set correctly in QuickBooks Online. Click the gear icon in the upper right, then click Your Company | Account and Settings | Advanced. If the First month of fiscal year isn’t correct, click the pencil icon over to the right and change it. Then click Save and exit out of this window.

Click the gear icon again and select Budgeting, then click Add budget in the upper right.

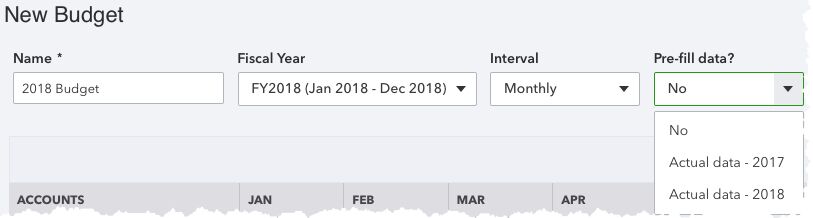

QuickBooks Online asks you the questions that need to be answered before you start filling in your budget grid.

The first thing you’ll do is give your budget a descriptive name by entering it in the Name field. Next, open the drop-down list under Fiscal year and select the correct 12-month period. You can create your budget in one of three intervals: Monthly, Quarterly, or Yearly. If you want to populate your budget with numbers from this year or last, make that selection in the Pre-fill data? field.

There’s one more option at the top of the Budgets Grid screen that’s not shown in the image above. You can Subdivide by Customer, Class, or Location. This can be useful if you want to view budget data specific to a subset of entries in each of those categories. You could, for example, choose three customers and view only their numbers in the grid individually, one at a time.

Providing Your Numbers

Once you’re satisfied with the selections you’ve made, click Create Budget in the lower right. The screen will refresh and display a grid that you can edit.

Let’s say you’re working on a budget for the second half of 2018. QuickBooks Online brought in your numbers for January-May. You see that the numbers don’t vary much from month to month on one specific line item, so you’re going to assume that they will continue to be true (unless you know something that will affect it after May). You could enter a rough average of the first five months in the JUN field.

Hover your cursor over the arrow to the side of that field, and this sentence appears in a small bubble: Click to copy the value across on the row. QuickBooks Online will then enter that number in the JUL through DEC fields.

QuickBooks Online can save you some time as you enter data in your budget grid fields.

When you’re done entering data in all of the fields relevant to your business, click Save in the lower right and close the window. Your budget will now show up in the list.

Tip: If you have multiple blank rows and don’t want them to be displayed, click the gear icon in the upper right corner of your budget page. Click in the box in front of Hide blank rows to create a checkmark.

The Hard Part

QuickBooks Online simplifies the mechanics of creating a budget, but it’s up to you to supply the numbers. There’s lots of common-sense advice that experts offer for this process, like:

Remember seasonal upswings and downswings. Make your goals as realistic as possible. You might want to create separate budgets for “needs” and “wants.” Track your expenses carefully for a period of time so you can estimate more confidently. Create reports regularly that compare your budget vs actuals.

QuickBooks Online can help you with that last piece of advice; it offers a report called Budget vs. Actuals. You’ll find it in the Business Overview group.

We can help, too. Once we understand a little more about your business structure and goals, we can take a look at your income and expense history and make some personalized recommendations. Connect with us soon, and we can start you on the path to a more focused financial future.

Social media posts

It may be halfway through the year, but you can still work on budgeting. QuickBooks Online can help; we can, too.

Thinking about creating a budget for 2019? Start now by tracking income and expenses carefully; you can use this year’s data to project next year’s numbers.

One of QuickBooks Online’s most useful reports is Budget vs. Actuals. Don’t have a budget? Let us walk you through creating one.

Here’s a budgeting tip: Create one budget for “wants” and another for “needs.” Let QuickBooks Online walk you through their creation.