Working with Contractors in QuickBooks Online

It’s a gig economy. QuickBooks Online makes it easy to track and pay independent contractors.

In days past we used to call it “moonlighting” – taking on a second, part-time job for extra money. And we saw how prevalent this became was when millions of people had to resort to side gigs to keep afloat during the economic downturn of a decade ago. Some who had lost full-time employment even turned one or more of these part-time passions into a small business and became independent contractors for other companies.

If you’re thinking of hiring a freelancer to do some of your work, you’ll find that QuickBooks Online can accommodate your accounting needs for them nicely. Since they’re not W-2 workers, your paperwork needs are minimal. They’ll simply fill out an IRS Form W-9 and you’ll pay them for services provided, dispatching 1099-MISCs after the first of each year so they can pay their taxes.

Here’s how it works.

Creating Contractor Records

Warning: Be sure that any independent contractor you hire cannot be considered an actual employee. The IRS spells out the differences very clearly and takes this distinction very seriously. If you have any doubts, we can help you determine your new worker’s status.

You can either let a new contractor complete his or her own profile or do so yourself.

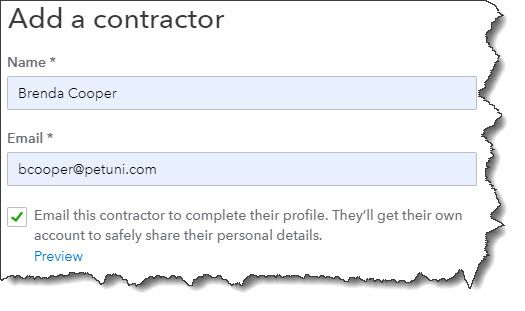

Like you would with anyone you employ, you’ll need to create records for contractors in QuickBooks Online. Click on Workers in the left navigation pane, then Contractors | Add a contractor. In the window that opens, enter the individual’s name and email address. If you want the contractor to complete his or her own profile, click in the box in front of Email this contractor…

Your contractor will receive an email with an invitation to create an Intuit account and enter W-9 information, which will be transmitted to your QuickBooks Online company account. This will make it easy to process 1099s when tax season arrives. He or she will also be able to use QuickBooks Self-Employed, an Intuit website designed for freelancers. We can walk you through how this works.

If you’d rather enter the worker’s contact details yourself, leave the box blank. A vertical panel containing fields for this information will slide out from the right.

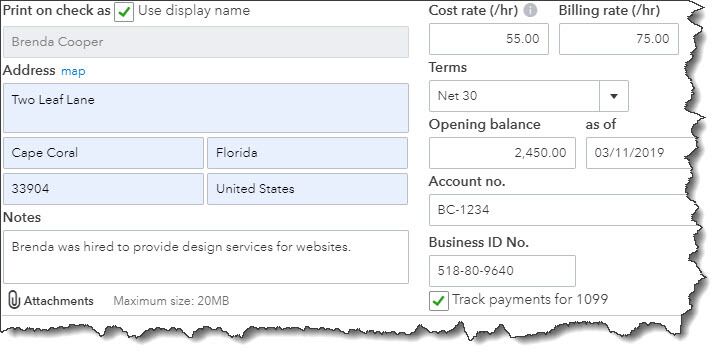

Contractors are also considered vendors. So when you create a record for a contractor, it will also appear in your Vendors list in QuickBooks Online. In fact, you can complete a contractor profile by clicking Expenses in the left vertical pane, then Vendors. Click New Vendor in the upper right and fill in the relevant fields there. Be sure to check the box in front of Track payments for 1099. An abbreviated version of your new record will also be available on the Contractors screen as the two are synchronized.

When you create a Vendor record for an independent contractor, be sure to check the Track payments for 1099 box.

Working with Contractors

You’ll notice in the screen shot above that Brenda Cooper had an Opening balance of $2,450 when you created her record. That’s money you already owed her, and for which she had probably sent you an invoice. QuickBooks Online turned that into an Accounts Payable item that you could find in multiple reports and on both the Vendors and Expenses screens. It will be listed as a Bill in reports, though you haven’t actually created one yet.

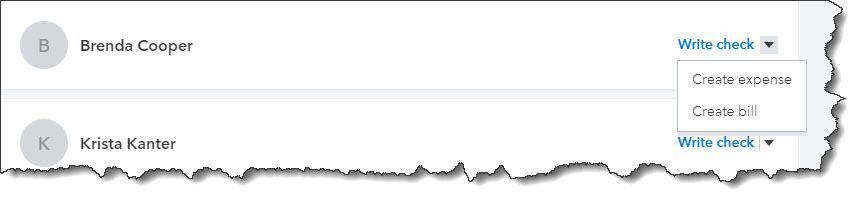

You have three options here. You can create a Bill and fill in any missing details if you don’t plan to pay Brenda immediately. If you want to send her the money right away, you can either enter an Expense or write a Check. There are many places in QuickBooks Online where you can do the latter two. We think it’s easiest to return to the Contractors screen, since you can accomplish all three from there.

The Contractors screen contains links to the three ways you can handle compensation due to a contractor.

Whenever you receive an invoice from a contractor, you can visit this same screen and choose one of the three options.

You’ll have to select a Category for your payment from the list provided in each of these three types of transactions. The Chart of Accounts contains one called Subcontractors, which may or may not work for your purposes.

We strongly encourage you to consult with us as you begin the process of managing independent contractor compensation to deal with this issue as well as others. QuickBooks Online offers multiple ways to get to the same end result, and it can be confusing. Contact us, and we can schedule a consultation.

Social media posts

Hiring independent contractors? Be sure they should be classified as such, and not employees. We can help you determine how to do this.

QuickBooks Online offers many ways to do the same tasks when you’re working with independent contractors. Here is how we can help you figure this out.

There are three ways to record financial obligations to independent contractors: bill, check, and expense. Do you know the differences? We can help you figure this out.

Though you don’t have the same payroll requirements for contractors as you do employees, it’s very important to get it right. Here are a few ways we can help you with this.